Get AN INSTANT loan today

Instant loan Germany

Free, 100% digital instant loan comparison

Save money on your instant loan with lower interest rates

Instant answers from up to 19 German lenders

An instant loan in Germany, known as Sofortkredit, sounds like quick cash on demand—but don’t be misled by the name. It’s still a classic personal installment loan with monthly repayments, interest, and a fixed term. The “instant” part refers to the speed of approval and payout—not the repayment. Lenders use the term mainly for marketing, but the appeal is real: fast decisions, no paperwork, and often same-day payout. Here’s how it works.

Summary: What You Need to Know

- Sofortkredit = Instant Loan: It’s a standard installment loan, just marketed as “instant” due to fast processing.

- Approval in Minutes: Many online lenders use automated checks to approve within minutes.

- Same-Day Payout Possible: If approved early in the day, funds can arrive the same afternoon.

- No Collateral Needed: These loans are typically unsecured, based on income and credit rating.

- Available to Expats: If you live in Germany, have a stable income, and a clean SCHUFA, you may qualify—even without German citizenship.

- Fixed Terms & Interest: Repayment happens monthly over 12–84 months, with interest based on your credit profile.

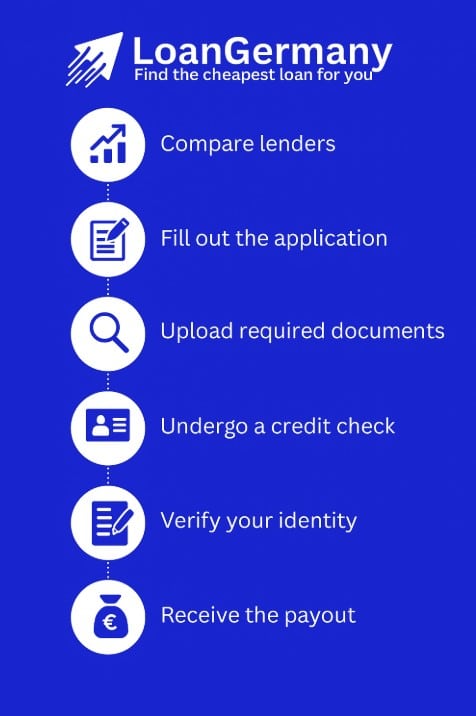

Step-by-Step: How to Get an Instant Loan in Germany

Getting a Sofortkredit in Germany is fast—but there’s still a process behind the speed. While the promise is “instant,” you’ll still need to go through several key steps, especially if you want the money the same day. Here’s how to do it right:

Quick Overview of the Process:

- Compare lenders

- Fill out the application

- Upload required documents

- Undergo a credit check

- Verify your identity

- Sign the loan contract

- Receive the payout

Step 1: Compare lenders

Start by using our tool in the top of the website. This tools let you get multiple offers based on your credit profile, loan amount, and term. Look for the effective APR (Effektiver Jahreszins)—it includes all costs, not just interest.

Step 2: Fill out the application

Once you find an offer, click through to the application. You’ll be asked for your full name, address, employment status, net income, and desired loan amount. This usually takes 5–10 minutes.

Step 3: Upload required documents

You’ll need to submit digital copies of:

- Valid ID (passport or ID card)

- Proof of income (last 2–3 payslips or pension statements)

- Possibly recent Kontoauszüge (bank statements)

Step 4: Undergo a credit check

The lender will perform a SCHUFA query to evaluate your creditworthiness. A clean record increases approval chances and lowers your interest rate. Some platforms offer a pre-check that won’t impact your SCHUFA.

Step 5: Verify your identity

You’ll verify your identity via VideoIdent (video call with ID) or PostIdent (at a Deutsche Post branch). Most online lenders use VideoIdent, which takes just a few minutes and speeds things up.

Step 6: Sign the loan contract

After approval, you’ll receive the loan agreement. Read the terms carefully, then sign it electronically. Some lenders require two-factor authentication for added security.

Step 7: Receive the payout

If you completed all steps early in the day and the bank processes transfers in real-time, the money can land in your account the same day. Otherwise, expect it within 1–2 business days.

What Is an Instant Loan / Sofortkredit and How Does It Work?

A Sofortkredit, or instant loan, is a marketing term for a regular installment loan with one key difference: the approval and payout happen fast. It’s still a binding credit agreement where you borrow a fixed amount and repay it in monthly installments—usually over 12 to 84 months—with interest.

What makes it “instant” isn’t the loan type, but the automation behind the process. Online lenders use real-time data checks, digital ID verification, and automated scoring systems to approve and transfer funds in record time—sometimes within hours.

Unlike payday loans or revolving credit, a Sofortkredit:

- Has a fixed interest rate and term

- Requires no collateral

- Can be used for any private purpose (e.g., medical bills, repairs, holidays)

- Is typically between €1,000 and €50,000

For many, it’s an ideal middle ground between speed and structure—offering fast liquidity without the unpredictability of overdrafts or credit cards.

Who Can Apply for an Instant Loan in Germany?

Instant loans aren’t just for German citizens—any resident with stable income and a good credit history can apply. That includes EU nationals, freelancers, and many expats with a valid residence permit. But lenders do have minimum eligibility criteria.

To qualify for a Sofortkredit, you typically need:

- Permanent residence in Germany

- Age 18 or older

- A German bank account (IBAN starting with DE)

- Proof of regular income (from employment, pension, or sometimes freelancing)

- A positive SCHUFA score (no major debt defaults or court-registered claims)

Some banks may also require:

- A valid German phone number

- A minimum monthly income (e.g., €1,100 net)

Note: Freelancers and self-employed individuals can apply, but they may face stricter checks or be offered higher interest rates. For expats, the main barrier is usually the SCHUFA record—if you’ve only recently moved to Germany, your credit file may be thin or non-existent.

What Documents Do You Need for a Sofortkredit?

Although the process is digital and fast, lenders still require basic documentation to verify your identity, income, and financial stability. These documents are uploaded online during the application process—often directly from your phone or computer.

Here’s what you’ll typically need to provide:

- Proof of Identity

- Valid passport or German national ID

- Non-EU citizens must include a valid Aufenthaltstitel (residence permit)

- Proof of Income

- Employees: Last 2–3 payslips

- Pensioners: Pension notice or bank statements showing regular pension payments

- Freelancers: Tax statements (e.g., Einnahmenüberschussrechnung) or last 3–6 months of bank statements

- Bank Account Details

- German IBAN for the payout

- Many lenders require access to recent Kontoauszüge (bank statements), often pulled automatically via secure Open Banking tools

- Address Verification (in some cases)

- Recent utility bill or Meldebescheinigung (residence registration certificate) if ID doesn’t include your address

Some lenders simplify the process with automated data imports, where you connect your online banking and skip uploading documents manually. Still, make sure the information matches—any inconsistencies can delay approval.

How to Apply for an Instant Loan Online

Applying for an instant loan online in Germany is designed to be quick, paperless, and user-friendly. The entire process—from selecting a lender to signing the contract—can often be completed in under 30 minutes. Here’s how it works:

- Choose a Platform or Lender

Use our tool at the top of the webiste to find offers tailored to your financial profile. - Start the Application

Once you’ve selected a loan, you’re redirected to the lender’s website. There you fill out a short online form with:- Personal details (name, address, marital status)

- Employment info (type of job, monthly net income)

- Desired loan amount and term

- Upload Your Documents

Most platforms let you upload your ID and income proof directly. Many now support mobile uploads, so you can take photos of your documents using your phone. - Complete a Credit Check

The lender will automatically request your SCHUFA report and other relevant credit data. If your score is high enough, you’ll receive a conditional approval within seconds. - Verify Your Identity

You’ll complete identity verification via VideoIdent—a short video call where you show your face and your ID. Alternatively, PostIdent can be done at a Deutsche Post branch, but it delays the process. - Sign the Loan Agreement

If everything checks out, you’ll receive the contract for digital signature. You sign using two-factor authentication, often via SMS code. - Get Your Payout

Depending on the time of day and your bank’s processing speed, the funds may arrive the same day or within 24–48 hours.

How to Speed Up Your Loan Approval

Even though instant loans in Germany are built for speed, the reality is that small delays often slow things down—especially around document handling and ID verification. With the right approach, you can drastically reduce processing time and get your payout faster.

Apply early in the day

Timing matters. Lenders typically process payouts during standard banking hours, and transfers initiated before noon are more likely to reach your account the same day.

Use a fully digital lender

Not all lenders offer the same automation. To avoid delays, choose one that supports online credit checks, digital signatures, and VideoIdent. Comparison platforms like Check24 often label these options as “fully digital.”

Enable access to your bank account

Many lenders now use Open Banking to access your transaction history directly and securely. This replaces the need to upload bank statements and allows instant income verification—speeding up approval significantly.

Have your documents ready

Before you apply, make sure you have a valid ID, recent payslips, and a stable internet connection for identification. A fully prepared application is less likely to trigger manual review.

Avoid data mismatches

Ensure that the income and employment details you enter match the documentation you submit. Discrepancies—like stating a net income of €2,500 but uploading payslips showing less—often result in delays or rejection.

When Is It Smart to Take an Instant Loan?

A Sofortkredit can be a useful financial tool—but only in the right situations. Since it’s still a formal debt agreement with interest and fixed repayment terms, it’s not something to take lightly. That said, there are valid scenarios where an instant loan makes clear sense.

Urgent but manageable expenses

If you face an unexpected cost—like a car repair, dental bill, or a broken household appliance—and don’t have enough savings, an instant loan offers quick relief without needing to tap into high-interest credit cards or overdrafts.

Bridging short-term gaps

Sofortkredit can help cover short-term liquidity gaps, such as delays in salary or invoices, especially for freelancers. But only if you’re confident the situation will normalize within a few months.

Avoiding worse financial outcomes

Sometimes, paying late fees, penalties, or losing a discount can cost more than the interest on a small loan. In such cases, taking a Sofortkredit can actually reduce overall expenses.

When you have a stable repayment plan

If you’ve budgeted and know you can comfortably repay the loan over the chosen term, it can be a smart way to spread out a larger expense without disrupting your finances.

However, using a Sofortkredit for non-essential spending—like vacations or shopping—can lead to unnecessary debt. The key is to ask: Is this solving a short-term problem, or creating a long-term one?

Credit Checks in Germany: What Lenders Look For

Every instant loan application in Germany includes a credit check, even if the approval is fast. Lenders need to assess whether you’re likely to repay the loan on time. The most important factor is your SCHUFA score—Germany’s central credit rating system—but other elements also play a role.

Here’s what lenders typically evaluate before granting a Sofortkredit:

- SCHUFA Score: A numerical rating based on your financial history, past loans, payment behavior, and any defaults or court claims.

- Current Debt Load: How many active loans or credit lines you already have.

- Income Stability: Whether your income is regular, sufficient, and backed by documentation.

- Employment Type: Permanent contracts carry more weight than temporary or freelance work.

- Account History: Lenders may check recent account activity via Open Banking to spot warning signs like frequent overdrafts.

- Age and Residency: Must be 18+ with official registration in Germany. Longer residence history can be a plus.

If your SCHUFA file is limited (e.g., you just moved to Germany), some lenders will reject your application—or offer only small loans at higher rates. In that case, building credit or using alternative providers might be the better path.

Alternatives to Instant Loans in Germany

A Sofortkredit isn’t your only option when you need fast access to money. Depending on your situation, other credit solutions may be cheaper, more flexible, or easier to obtain—especially if your SCHUFA score is low or your income is irregular.

Here are some common alternatives used in Germany:

- Overdraft (Dispositionskredit): Built into most checking accounts. Easy to use, but expensive—often with 10–14% interest. Best for very short-term needs.

- Credit Cards: Revolving credit with flexible repayment. Interest rates are often high, but credit cards offer grace periods and purchase protection.

- Buy Now, Pay Later (BNPL): Services like Klarna or PayPal offer deferred payments for online purchases—interest-free if paid on time.

- Peer-to-Peer Lending (P2P): Platforms like Auxmoney connect you with private investors. Approval criteria are sometimes more flexible than banks.

- Salary Advance or Employer Loans: Some companies offer Vorschuss (salary advance) or internal loan programs with no interest.

- Family or Friends: Borrowing privately may avoid fees and interest—if trust and repayment terms are clear.

Choosing the right option depends on how fast you need the money, how much you need, and whether you can repay within a short or long timeframe.

How to Save on Loan Fees and Interest Rates

Even with a fast approval, a Sofortkredit can become expensive if you’re not careful. Interest rates, processing fees, and hidden costs vary widely between lenders—so knowing how to reduce the total loan cost is essential.

Here’s how you can save money when taking an instant loan in Germany:

- Compare the effective APR (Effektiver Jahreszins): This includes all costs—not just interest. A loan with 3.5% nominal interest but 6.8% effective APR may hide additional fees.

- Use loan comparison platforms: Sites like Check24, Verivox, or Smava give you real-time offers based on your credit profile, making it easier to spot the best deals.

- Avoid unnecessary extras: Many lenders offer optional add-ons like residual debt insurance (Restschuldversicherung). These often come at a high cost and aren’t mandatory.

- Choose the shortest affordable term: A shorter term means higher monthly payments—but less interest paid over time. Stretching the loan too long increases the total cost.

- Look for early repayment options: Some lenders allow you to pay off your loan early without penalties. This flexibility can save you interest if your financial situation improves.

By staying critical during the selection process and reading the fine print, you can get the liquidity you need—without overpaying for it.

FAQs

Can foreigners apply for an instant loan?

Yes, as long as you live in Germany, have a residence permit, and meet the income and credit criteria.

How fast is the payout really?

If your application is fully digital and completed early in the day, funds can arrive the same day. Most payouts happen within 24–48 hours.

What happens if I miss a payment?

Missed payments can result in reminder fees, interest penalties, and a negative SCHUFA entry. Communicate with your lender early if you face difficulties.

Do I need a German bank account?

Yes. Payouts and repayments require a DE-IBAN linked to a German account.