Get a Renovation Loan today

Home renovation loan Germany

Free, 100% digital renovation loan comparison

Save money on your renovation loan with lower interest rates

Instant answers from up to 19 German lenders

Loan Example:0.68% interest: 2/3 of all customers receive: Net loan amount €50,000.00, 60-month term, 8.70% effective annual interest rate, 8.37% fixed annual borrowing rate, 60 monthly installments of €1,022.73 each, total amount €61,363.57, Vereinigte Volksbank Raiffeisenbank eG, Darmstädter Str. 62, 64354 Reinheim. (§17 PAngV)

Planning to renovate your home in Germany? If you own the property, you may qualify for a renovation loan with favorable terms. But if you’re a tenant, these loans aren’t available to you—you’ll need to consider a personal loan instead. Renovation loans are designed for homeowners who want to upgrade, modernize, or improve energy efficiency. Used wisely, they can increase both comfort and property value—without draining your savings. Here’s what you need to know.

Summary: What You Need to Know

- Only property owners can take out renovation loans in Germany.

- Tenants must use personal loans if they want to finance upgrades.

- Renovation loans are installment-based, often with lower rates than standard consumer loans.

- The loan amount depends on property value, renovation scope, and your credit rating.

- You can finance improvements like insulation, heating systems, windows, or bathroom upgrades.

- Lenders require proof of ownership, cost estimates, and income documentation.

How to Get a Renovation Loan in Germany

Applying for a renovation loan in Germany is more complex than getting a quick personal loan. Since the loan is tied to your property and the planned construction work, lenders require detailed documentation and a clear renovation plan. The good news? If you’re prepared, the process is straightforward—and rates are often more favorable than consumer credit.

Main steps to get a renovation loan in Germany:

- Compare renovation loan offers

- Check eligibility and creditworthiness

- Prepare required documents

- Submit application with renovation details

- Verify identity and sign contract

- Receive payout and begin renovations

Compare renovation loan offers

Start by checking multiple providers—use loan comparison platforms like Check24 or Verivox. Look at the effective APR, loan terms, and whether they offer loans specifically for renovation (not just general-purpose credit).

Check eligibility and creditworthiness

Most lenders require you to:

- Own the property being renovated

- Have a stable income

- Show a clean or acceptable SCHUFA score

Some may also request a property valuation or proof of equity.

Prepare required documents

Before applying, gather:

- ID and proof of residence

- Proof of property ownership

- Income documentation (payslips, tax returns)

- Cost estimates or quotes from contractors

Submit application with renovation details

Fill out the online or offline application and include the purpose of the loan, renovation type, and timeline. Many banks want cost breakdowns and details on materials or contractors involved.

Verify identity and sign contract

Most lenders use VideoIdent or PostIdent for ID verification. Once approved, you sign the contract—often digitally—and receive confirmation of the loan agreement.

Receive payout and begin renovations

After contract signing, the loan is usually paid out within a few business days. Some lenders pay the full amount at once, while others release funds in stages based on renovation progress.

What Is a Renovation Loan in Germany?

A renovation loan in Germany is a secured or unsecured installment loan used specifically to finance improvements to a property you own. Unlike general-purpose personal loans, renovation loans are tied to a clear construction or modernization project—and in some cases, even to the value of the home itself.

They’re typically used to finance upgrades such as:

- Energy-efficient windows and doors

- New heating or solar systems

- Roof repairs or insulation

- Bathroom and kitchen renovations

- Structural improvements

HHow renovation loans differ from mortgages

A renovation loan isn’t the same as a mortgage. While a mortgage is used to purchase property, a renovation loan is used after you already own the property, to finance upgrades. However, some banks offer combined products where renovation costs are added to the home purchase financing.

Loan structure and repayment

Renovation loans are paid back in monthly installments over a fixed period, typically between 12 and 120 months. They often come with lower interest rates than unsecured personal loans, especially if the property is used as collateral.

Tax and subsidy options

Depending on the type of renovation (e.g. energy efficiency), you may qualify for government grants or KfW subsidies—these can reduce your overall borrowing costs or improve your loan terms.

Renovation, Sanierung, or Modernisierung – What’s the Difference?

In Germany, the terms Renovierung, Sanierung, and Modernisierung refer to different types of property improvements. While they often overlap in practice, they serve different purposes—and lenders treat them differently. Understanding which type your project falls under is essential for choosing the right loan and getting approved faster.

Comparison of Common Home Improvement Terms

| Term | Purpose | Typical Work Examples | Increases Property Value? | Eligible for Subsidies? |

|---|---|---|---|---|

| Renovierung | Cosmetic repairs & maintenance | Painting, wallpapering, replacing tiles | Not significantly | Rarely |

| Sanierung | Repairing structural or health issues | Mold removal, pipe replacement, roof repairs | Sometimes | Sometimes (depending on scope) |

| Modernisierung | Upgrading to modern standards | Insulation, heating systems, solar panels | Yes | Often (e.g. KfW programs) |

Which category fits your project?

If you’re just repainting or fixing surface wear, you’re doing a Renovierung. If you’re repairing serious issues like water damage or outdated electrics, it’s Sanierung. But if your goal is long-term value or energy savings, you’re looking at a Modernisierung—and that’s where financing and subsidies are most attractive.

Who Can Apply for a Renovation Loan?

Renovation loans in Germany are not available to everyone. They’re designed specifically for property owners, meaning you must own the home you plan to renovate. If you’re a tenant, you’ll need to finance any upgrades with a personal loan, as banks won’t offer secured renovation financing for properties you don’t legally own.

Basic eligibility criteria

To apply for a renovation loan, you typically need to meet the following:

- Property ownership in Germany (house or apartment)

- Registered residence in Germany

- Minimum age of 18

- Stable monthly income (from employment, pension, or business)

- Valid ID and residence permit (for non-citizens)

- Good SCHUFA score or alternative credit record

Can foreigners apply?

Yes—EU citizens and many non-EU residents can apply, provided they have legal residence and meet the income and ownership requirements. Some banks may impose stricter terms for non-citizens, such as requiring longer residency or additional documentation.

What if the property is co-owned?

If you co-own the property with a spouse or partner, some lenders may require both parties to co-sign the loan, especially if the renovation affects the shared property’s value or structure.

What Can You Use a Renovation Loan For?

Renovation loans in Germany can cover a wide range of property improvements—but only if they’re linked to the structure or function of the home you own. The key requirement is that the work adds value, improves habitability, or increases energy efficiency. Purely decorative projects may not qualify unless bundled with structural work.

Common eligible purposes

- Structural repairs: roof replacement, facade renovation, foundation repairs

- Energy upgrades: insulation, new windows, heat pumps, solar panels

- Interior improvements: bathroom remodels, kitchen upgrades, flooring, electrical rewiring

- Safety & compliance: replacing outdated plumbing or wiring, fire protection systems

- Accessibility improvements: installing lifts, widening doorways, barrier-free modifications

What’s usually not covered?

Expenses that don’t directly improve the home’s value or function—like furniture, garden decorations, or home appliances—are typically not eligible for renovation loans. For such costs, a personal loan would be more appropriate.

Combining multiple projects

Many homeowners use a renovation loan to bundle several improvements into a single financing plan. For example, updating your bathroom, improving insulation, and modernizing the heating system can all be financed under one loan if they’re part of a comprehensive renovation plan.

How Much Can You Borrow – and What Does It Cost?

The loan amount you can access depends on whether you’re applying for a renovation loan as a property owner or a personal loan as a tenant. Renovation loans are often larger and come with better rates—but only if you own the property being improved. If you’re a tenant looking to upgrade a rental, a personal loan is your only financing option.

Example: Renovation loan vs. personal loan for €30,000

| Loan Type | Term | Interest Rate | Monthly Payment | Total Repayment |

|---|---|---|---|---|

| Renovation Loan | 10 years | 4.5% | ~€310 | ~€37,200 |

| Personal Loan | 10 years | 7.5% | ~€360 | ~€43,200 |

Key differences

- Interest rates: Personal loans have higher interest due to being unsecured.

- Loan limits: Renovation loans can be larger, especially if secured by property.

- Approval process: Renovation loans require more documentation (e.g. property proof, contractor quotes).

- Flexibility: Personal loans are easier to obtain but cost more over time.

If you’re planning a major upgrade and own your home, a renovation loan is clearly the cheaper option. But for smaller, cosmetic improvements as a tenant, a personal loan may be more practical.

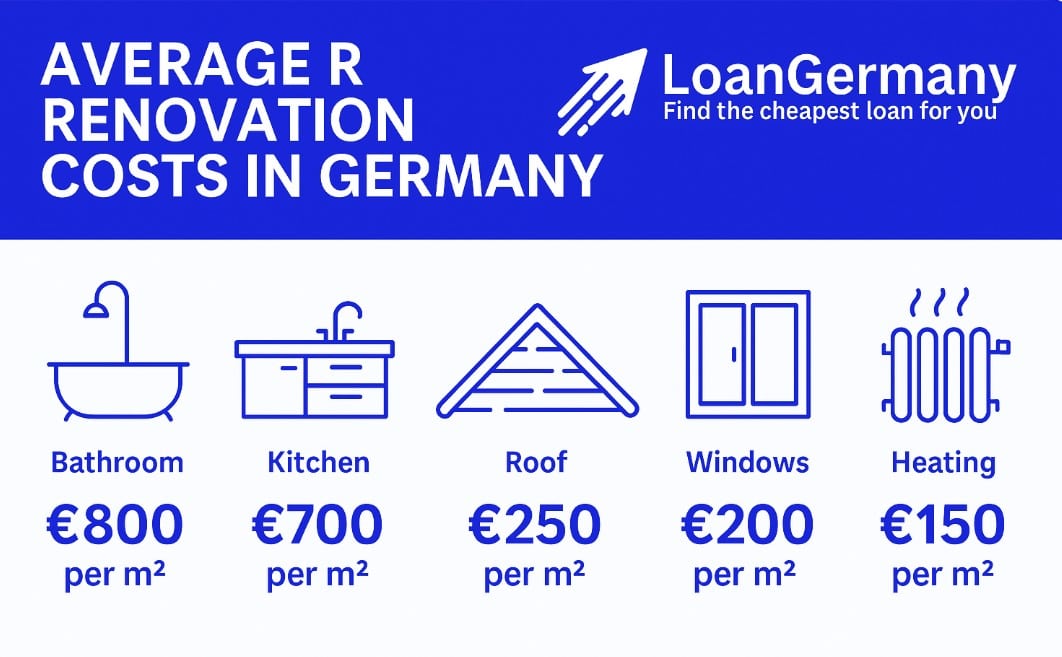

Average Renovation Costs in Germany

Before applying for a loan, it’s important to know what typical renovation projects actually cost. Prices vary depending on the region, materials, and whether you hire professionals—but the estimates below give a reliable baseline.

Typical cost ranges for common renovations

| Project Type | Average Cost per m² | Total Cost (approx.) |

|---|---|---|

| Bathroom renovation | €800 – €1,500 | €10,000 – €20,000 (full refit) |

| Kitchen renovation | €500 – €1,200 | €8,000 – €15,000 |

| Roof replacement | €150 – €300 | €12,000 – €25,000 |

| Insulation (facade/walls) | €100 – €200 | €8,000 – €18,000 |

| Window replacement | €500 – €900 each | €6,000 – €12,000 (whole house) |

| Floor replacement | €30 – €100 | €3,000 – €8,000 |

| Heating system upgrade | €7,000 – €20,000 | Fixed cost, incl. installation |

Things that affect renovation pricing

- Labour costs: Higher in urban areas like Munich, Hamburg, and Frankfurt.

- Material choices: Basic vs. premium finishes can double the price.

- Scope of work: Full system replacements cost more than partial repairs.

- Permits and inspections: Some renovations require prior approval or certification.

- VAT (MwSt): Standard rate is 19%, included in most contractor quotes.

Having a detailed cost estimate strengthens your loan application and helps avoid under-financing the project.

Required Documents for a Renovation Loan

Applying for a renovation loan in Germany involves more paperwork than a standard consumer loan. Since the financing is tied to a specific property and construction purpose, lenders require detailed documentation—not just about your finances, but also about the renovation itself.

Document checklist

- Proof of property ownership (e.g. Grundbuchauszug)

- Valid photo ID (passport or Personalausweis)

- Residence permit (if non-EU applicant)

- Last 2–3 payslips or income statements

- Recent bank statements (Kontoauszüge)

- Renovation cost estimates or contractor quotes

- Description of renovation work (project summary)

- Building permits (if required)

- Proof of residence (Meldebescheinigung)

Digital uploads and verification

Many lenders allow you to upload all documents online, either via scanned files or smartphone photo uploads. Some use Open Banking tools to access account data directly, which can speed up the approval process and reduce manual checks.

Tips for faster approval

- Make sure your renovation quote matches the loan amount

- Submit a clear breakdown of costs per task or room

- Include timeline and estimated start date for the work

- Ensure your name appears on all ownership and address documents

How to Find the Cheapest Renovation Loan

Renovation loans can vary widely in cost—even for applicants with similar income and credit. To avoid overpaying, it’s essential to compare offers from multiple providers and understand the total cost of each loan, not just the monthly rate.

We’ve made it easy: use the loan tool at the top of this page. After entering your desired amount and term, you’ll receive personalized offers directly from trusted lenders. There’s no obligation, and using the tool won’t affect your credit score.

What to look for when comparing offers

- Effective APR (effektiver Jahreszins): This includes all fees and gives the clearest cost overview.

- Term flexibility: Choose a term that balances affordability and interest savings.

- Early repayment terms: Look for loans that allow extra payments or early payoff with no penalties.

- No unnecessary insurance: Some banks bundle optional credit insurance that drives up costs—only add this if it’s truly needed.

Submit multiple applications, but wisely

Using platforms that offer non-binding pre-checks (like ours) allows you to compare offers without impacting your SCHUFA. Only submit formal applications once you’ve identified the best deal.

What to Consider Before Taking a Renovation Loan

Before signing a renovation loan agreement, take time to evaluate whether the loan—and the renovation itself—aligns with your financial situation, long-term plans, and property goals. A good loan can increase property value, but a poorly planned one can lead to unnecessary debt or financial strain.

Is the renovation truly necessary?

Focus on projects that improve functionality, energy efficiency, or long-term value. Cosmetic upgrades are tempting, but they rarely justify long-term financing unless paired with structural improvements.

HCan you handle the monthly payments?

Review your current budget and make sure the loan doesn’t stretch you too thin. Factor in unexpected renovation costs, which often arise mid-project.

HHave you explored subsidies or grants?

For energy upgrades or accessibility improvements, KfW loans and BAFA grants may cover part of the cost or reduce interest rates. Check eligibility before applying for standard financing.

Will the renovation increase property value?

Some renovations offer high return-on-investment (e.g. heating systems, insulation), while others—like luxury kitchens—may not add much market value. Think like a future buyer if resale is a possibility.

Do you plan to sell or move in the next few years?

Taking a 10–15 year loan makes less sense if you’re planning to relocate soon. In that case, a smaller scope project or personal loan might be more flexible.

Frequently Asked Questions (FAQ)

Can I get a renovation loan if I rent my apartment?

No. Renovation loans are only available to property owners. If you’re a tenant, you’ll need to use a personal loan for any upgrades.

What’s the difference between a renovation loan and a personal loan?

Renovation loans are often secured, tied to the property, and offer lower interest rates. Personal loans are unsecured, more flexible, but usually more expensive.

How long does it take to get the money?

After approval, funds are usually paid out within a few business days. If the loan is tied to construction stages, payouts may be staggered.

Can non-German citizens apply for renovation loans?

Yes, if you have residence in Germany, stable income, and property ownership. Some banks may ask for additional documentation for non-EU applicants.